Orderflows Shifts

see shifts in the order flow between aggressive traders and passive traders

Hi, my name is Michael Valtos and I spent 20 years as an institutional trader at JP Morgan, Cargill, Commerzbank, EDF Man and Dean Witter Reynolds. The one thing that I have found to be single most important part of market analysis is order flow because it gets you as close to the market as possible so you can best analyze what is happening in the market and, more importantly, why its happening in the market.

Many traders don't realize that the type of trading taking place in the market determines how the market will react and move. There are different types of buyers and sellers. There are aggressive buyers and aggressive sellers as well as passive buyers and passive sellers. Knowing the type of trading going on will help you determine if a trend will end and a new trend begin or if a trend still has enough strength to continue.

Many traders don't realize that the type of trading taking place in the market determines how the market will react and move. There are different types of buyers and sellers. There are aggressive buyers and aggressive sellers as well as passive buyers and passive sellers. Knowing the type of trading going on will help you determine if a trend will end and a new trend begin or if a trend still has enough strength to continue.

But let's face it, for many traders, trying to read and understand order flow is a daunting task. Some traders just take to it like a fish to water. But for other traders it takes time to fully utilize the market generated information the order flow offers a trader.

To solve that problem I created the Orderflows Flowshifts indicator which allows traders to harness the power of order flow without having to do the analysis themselves. Let the computer do the analysis for you. The computer can process a lot more information than a human can and at speeds the human brain in not capable of. Let the computer do the heavy lifting.

To solve that problem I created the Orderflows Flowshifts indicator which allows traders to harness the power of order flow without having to do the analysis themselves. Let the computer do the analysis for you. The computer can process a lot more information than a human can and at speeds the human brain in not capable of. Let the computer do the heavy lifting.

Don't Focus Only On Price

Trading the market is not just about watching price movement. There are many different moving parts to the market, and you have to be using them. Looking at price go up or down is not really giving you the full story. You can’t survive trading a single market perspective. You have to integrate the other information the market generates.

Its not the candles or chart that cause the market to go up or down. It is the aggressive traders. What causes moves to end? It can be a few things. Aggressive traders may have weakened. Resting liquidity can be strong. There could be a shift in market expectations. But what matters is being able to recognize this shift in trading activity. That is exactly what the Orderflows Shifts is designed to discover and show you.

That is why order flow is so important. Instead of just looking at price movements, order flow traders look at movements based on the aggressiveness and lack of aggressiveness of traders. Areas where buyers form support and sellers form resistance in real-time. Price levels were volume form balance. Order flow really allows a trader to better understand what is really happening in the market based on how it is trading.

Its not the candles or chart that cause the market to go up or down. It is the aggressive traders. What causes moves to end? It can be a few things. Aggressive traders may have weakened. Resting liquidity can be strong. There could be a shift in market expectations. But what matters is being able to recognize this shift in trading activity. That is exactly what the Orderflows Shifts is designed to discover and show you.

That is why order flow is so important. Instead of just looking at price movements, order flow traders look at movements based on the aggressiveness and lack of aggressiveness of traders. Areas where buyers form support and sellers form resistance in real-time. Price levels were volume form balance. Order flow really allows a trader to better understand what is really happening in the market based on how it is trading.

Take Advantage Of Information Other Traders Don't Have

Orderflows Flowshifts was created to allow a trader to take advantage of the information the order flow provides. Markets move based on the actions of aggressive traders, the traders who buy the offer or sell the bid. They clear out the liquidity in the market. But what if the resting liquidity is stronger than the aggressive traders? What do you think happens to the market? It can be enough to support a market or provide resistance. The Orderflows Shifts identifies when the resting liquidity is enough to potentially absorb the aggressive trading.

Let's face it, trading often comes down to information. But it is not simply a case of having the best information. A trader has to utilize that information in order to capitalize on it. The Orderflows Flowshifts give a trader an edge by adding order flow to his trading arsenal.

The reason most traders fail at trading by relying strictly on price movements alone is because they lack market context. They just see what the market did instead of knowing the how and why. The Orderflows Flowshifts add the market context that is missing in so much of market analysis today.

Let's face it, trading often comes down to information. But it is not simply a case of having the best information. A trader has to utilize that information in order to capitalize on it. The Orderflows Flowshifts give a trader an edge by adding order flow to his trading arsenal.

The reason most traders fail at trading by relying strictly on price movements alone is because they lack market context. They just see what the market did instead of knowing the how and why. The Orderflows Flowshifts add the market context that is missing in so much of market analysis today.

The Fastest Way To Add Order Flow Analysis To Your Trading!

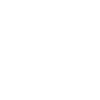

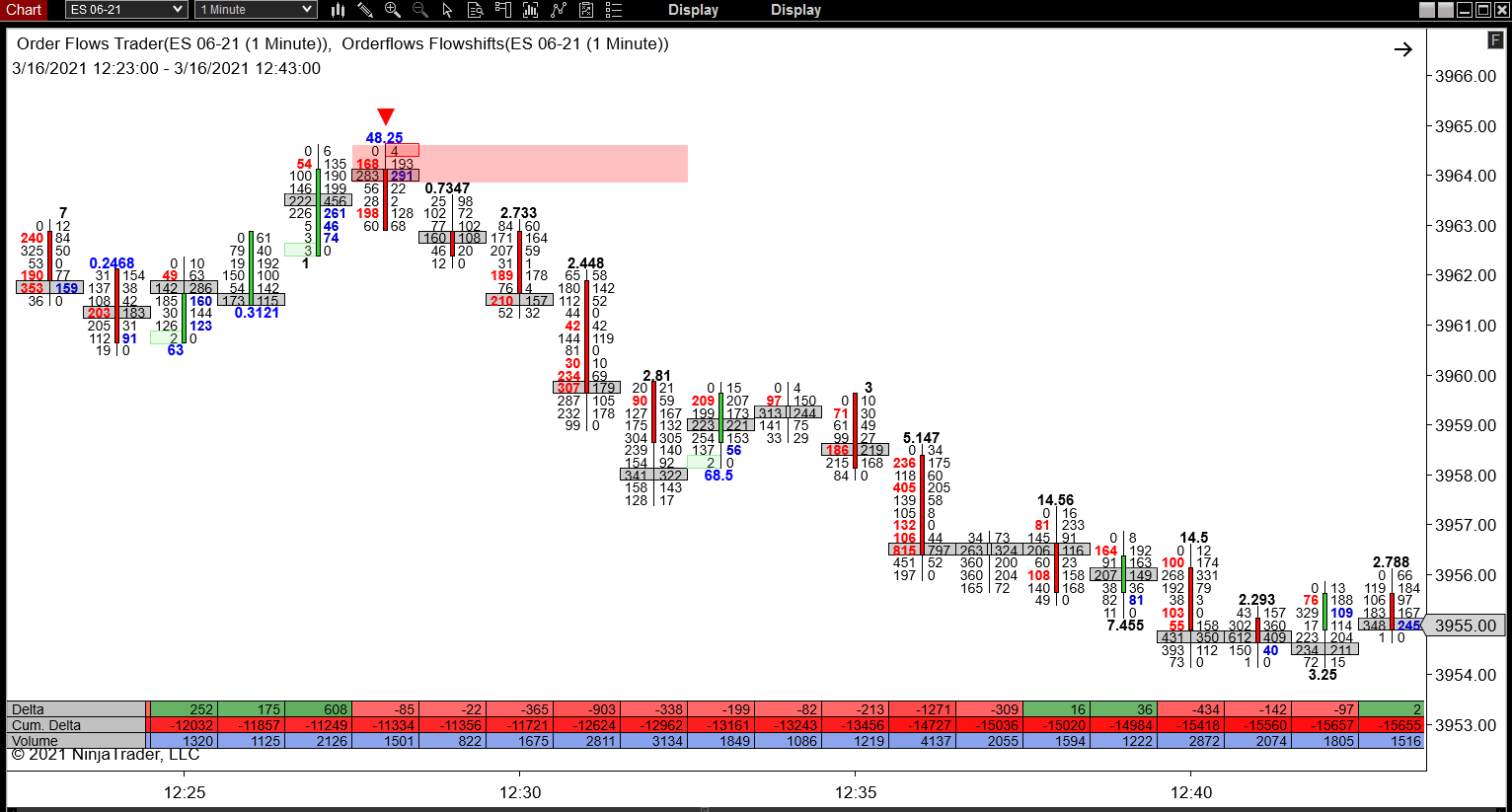

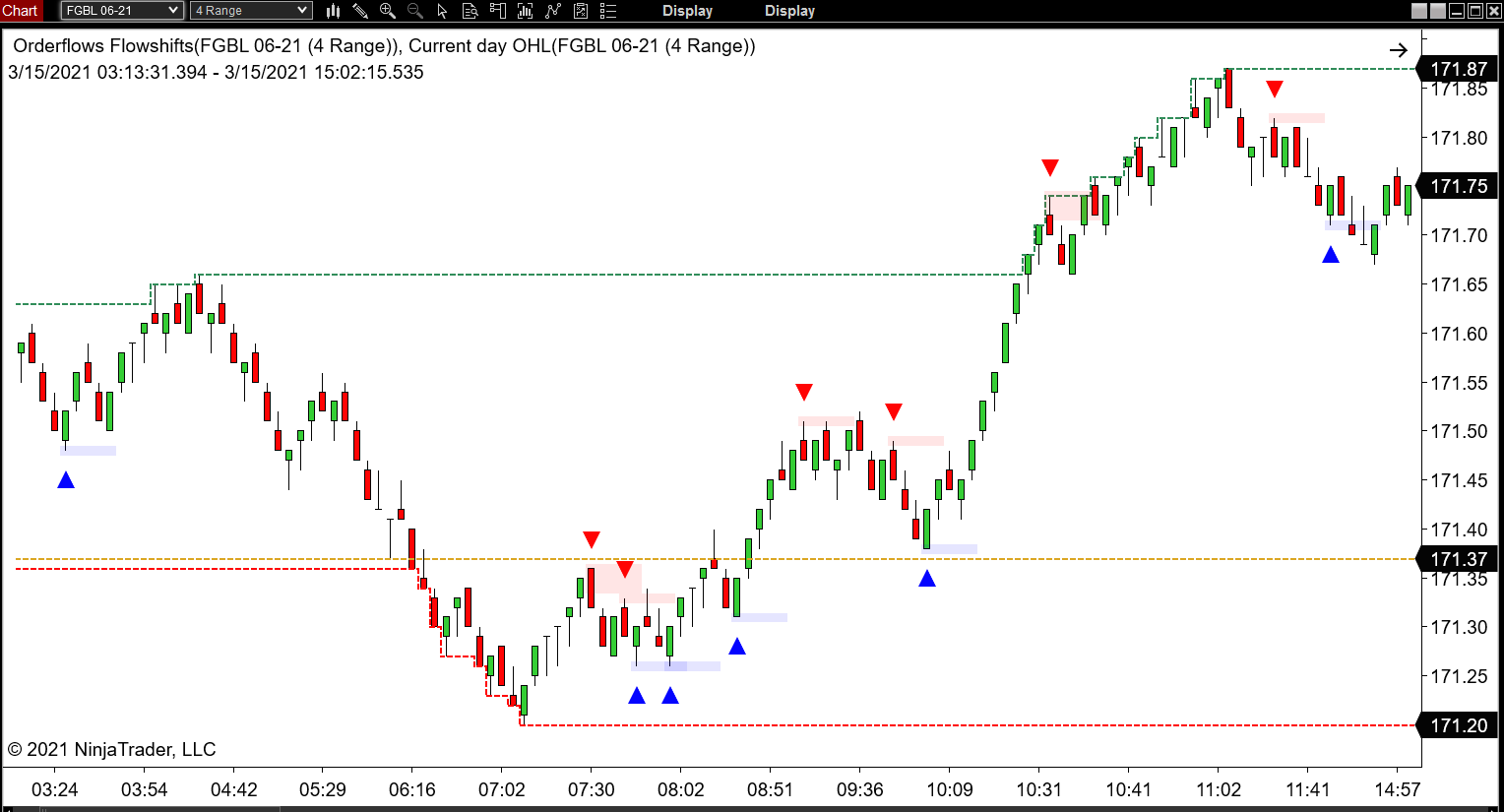

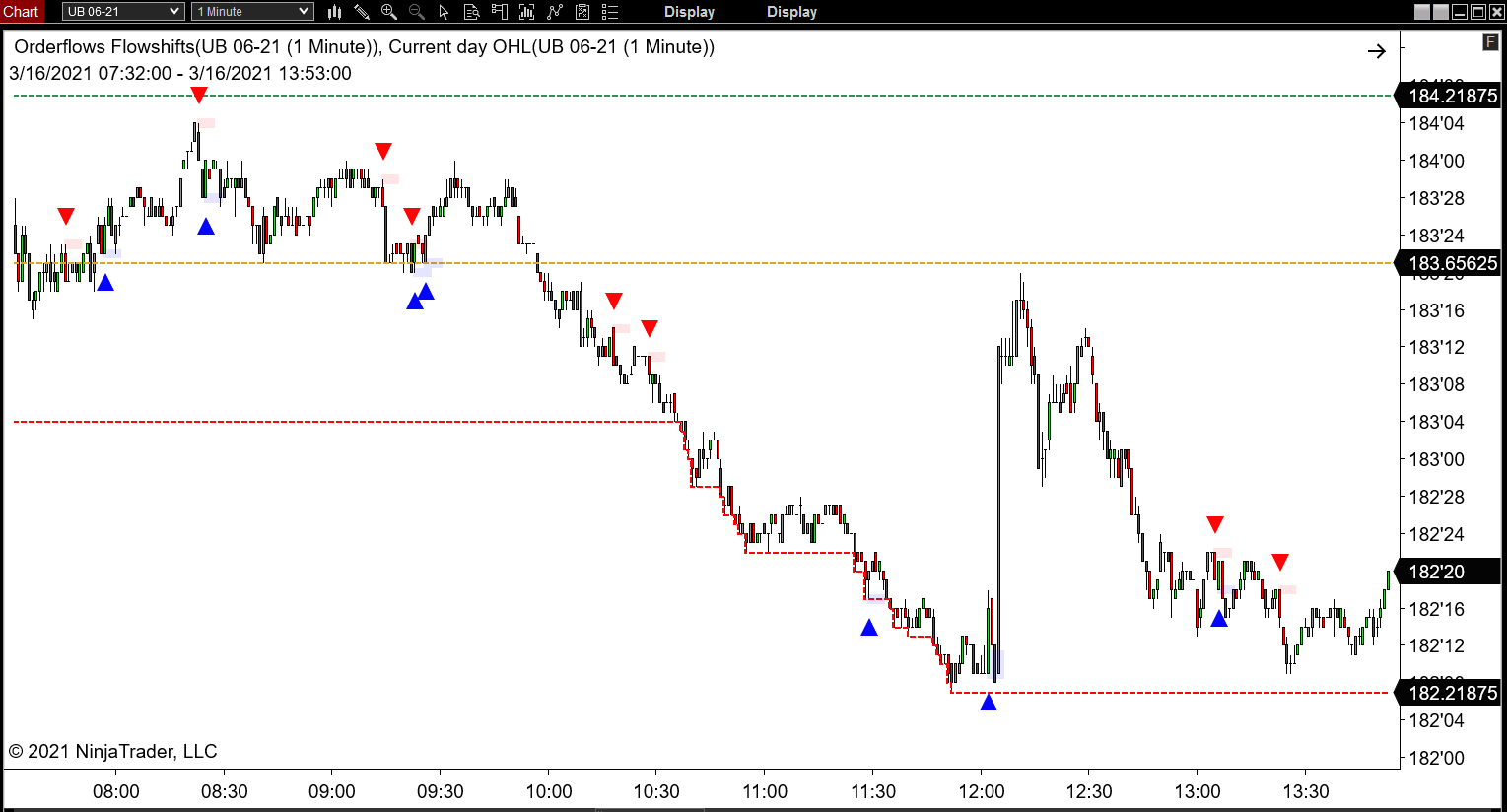

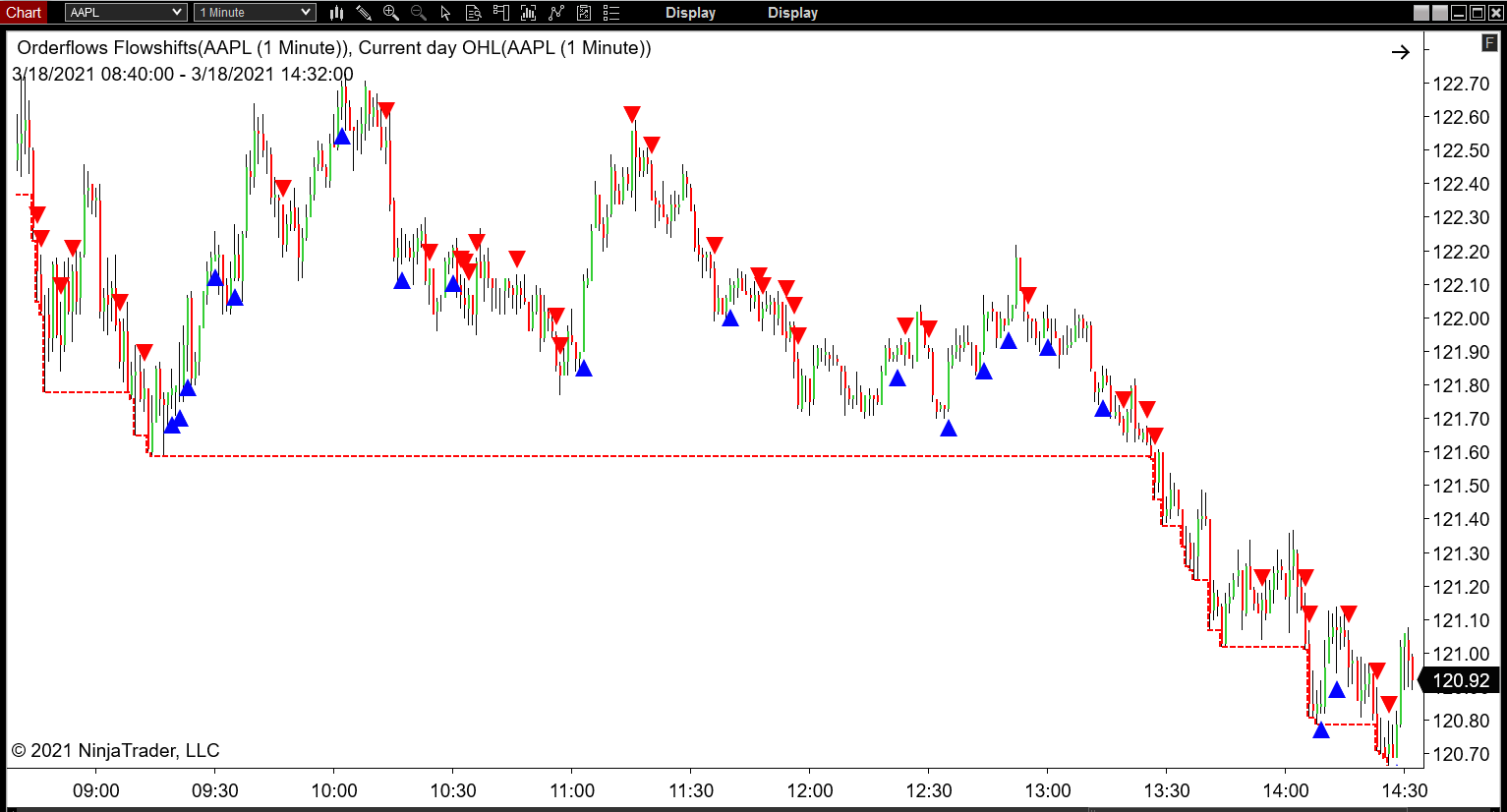

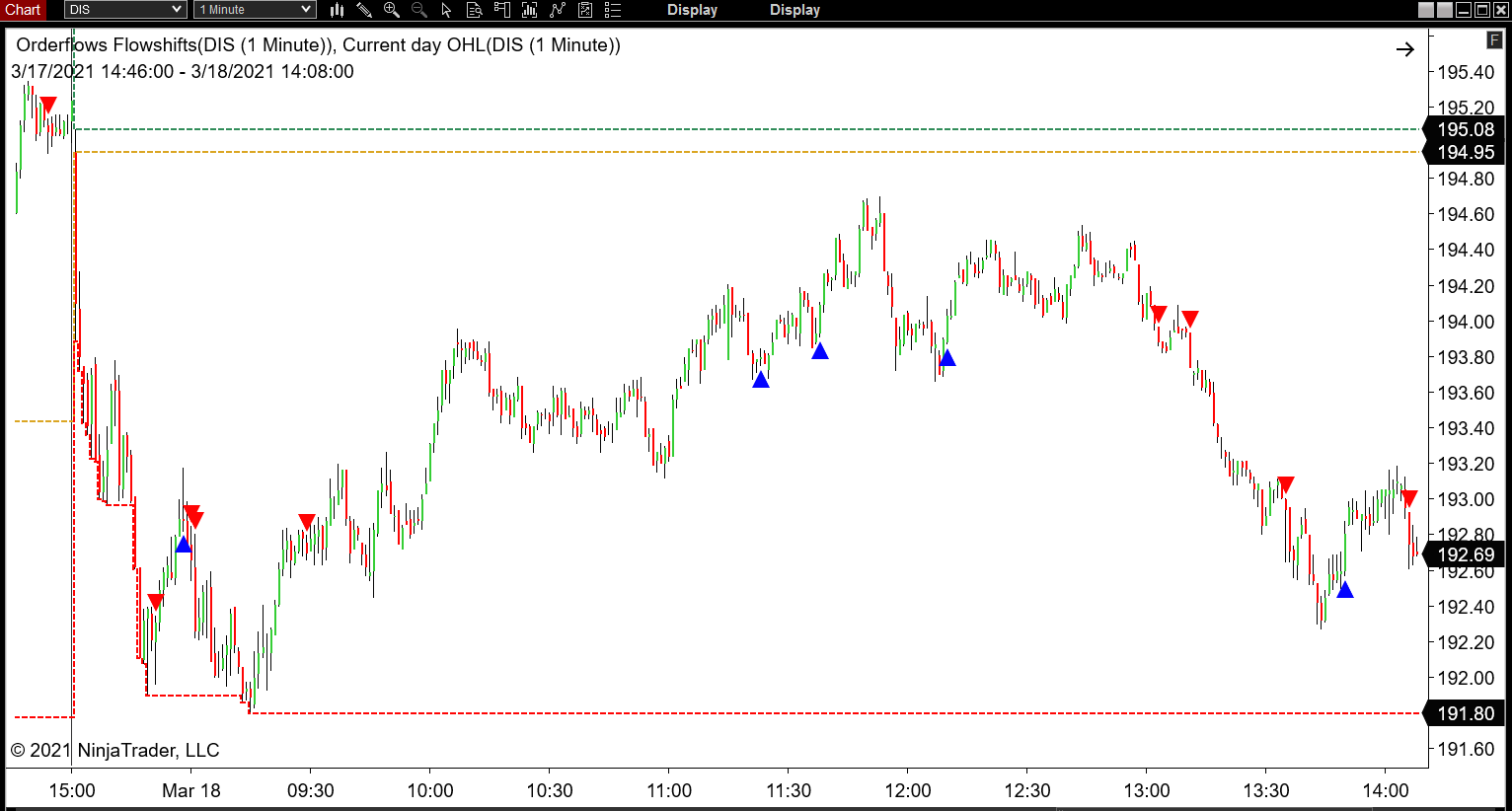

Let's Take A Look At The Charts

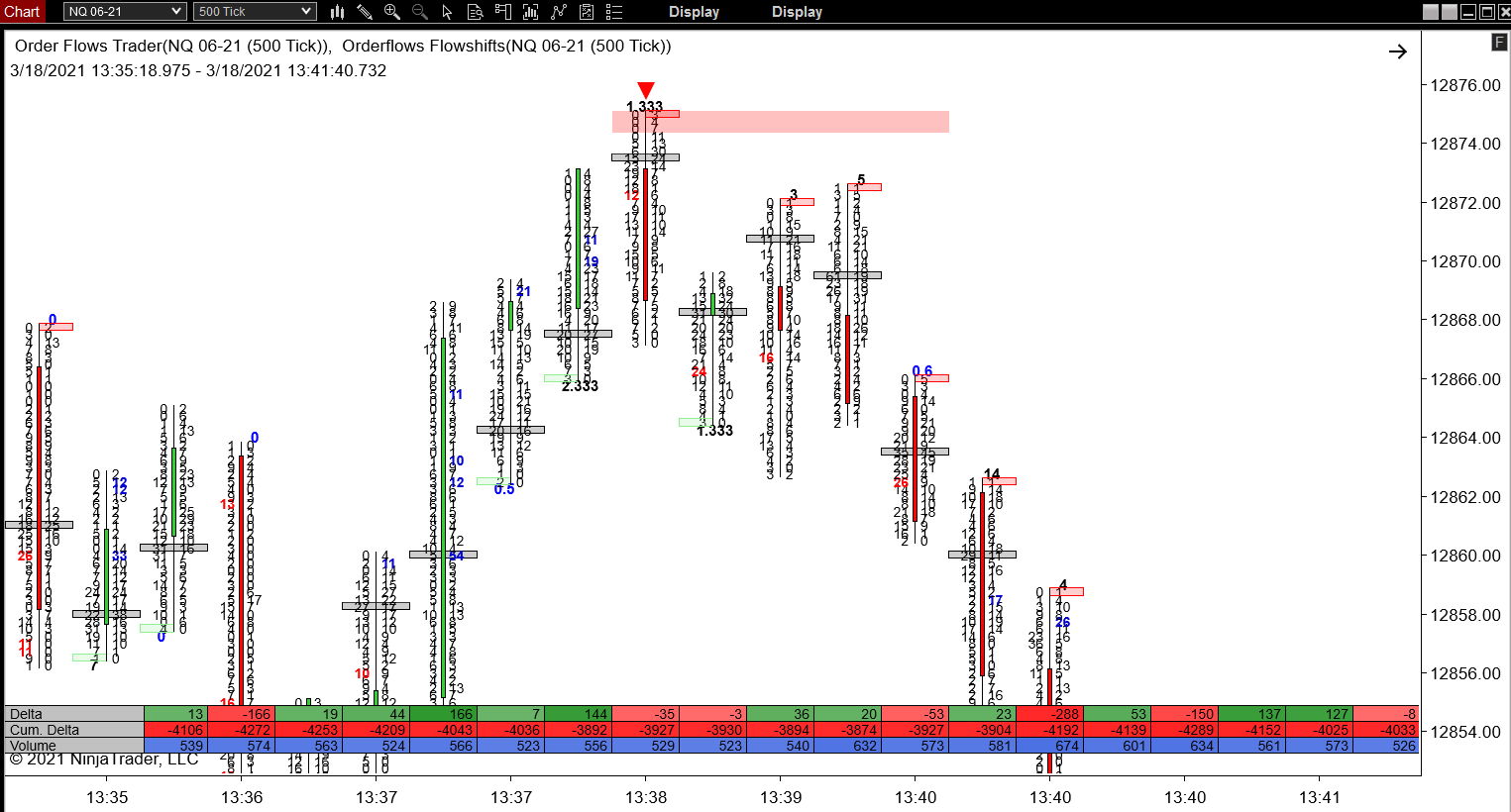

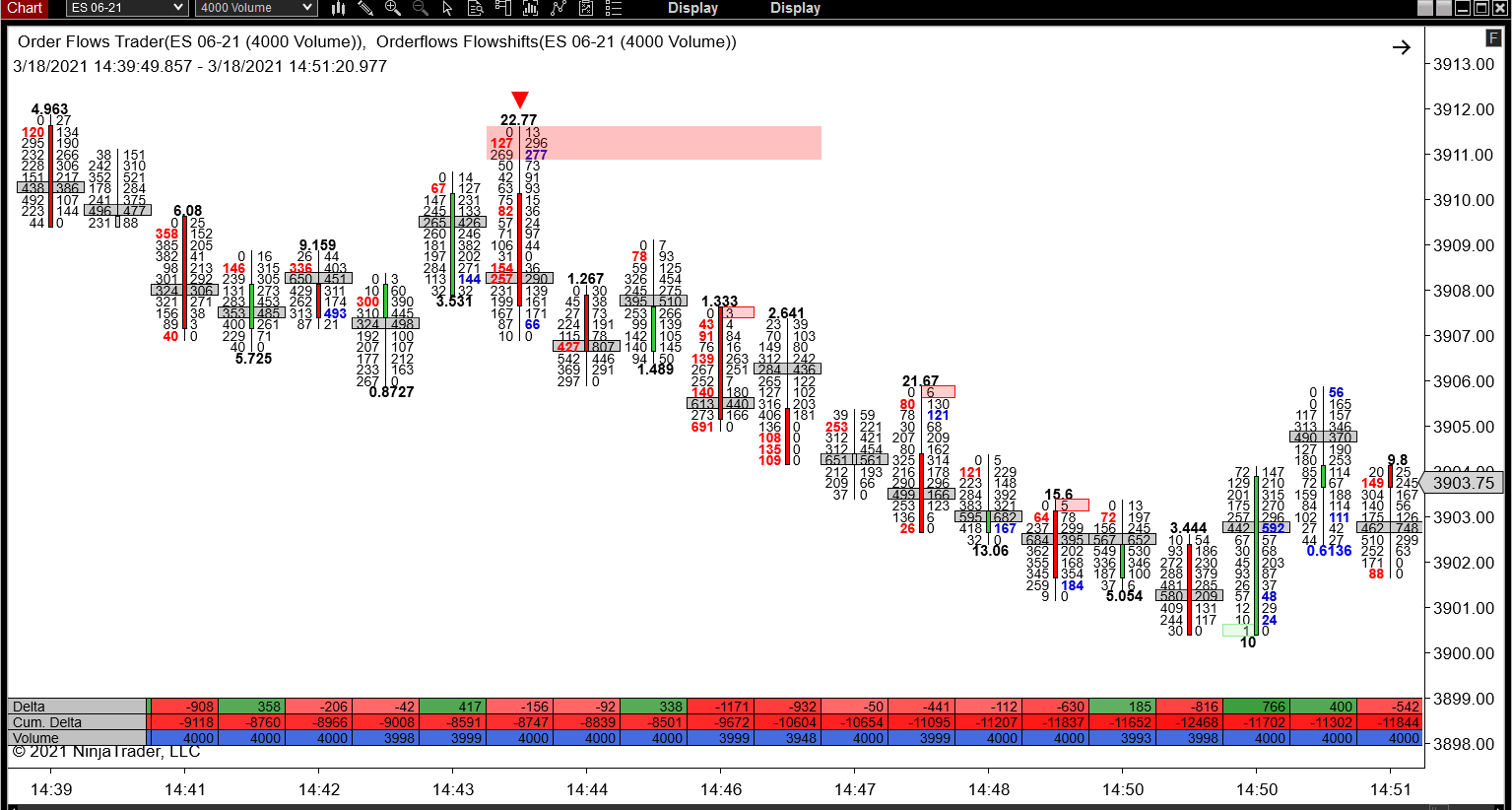

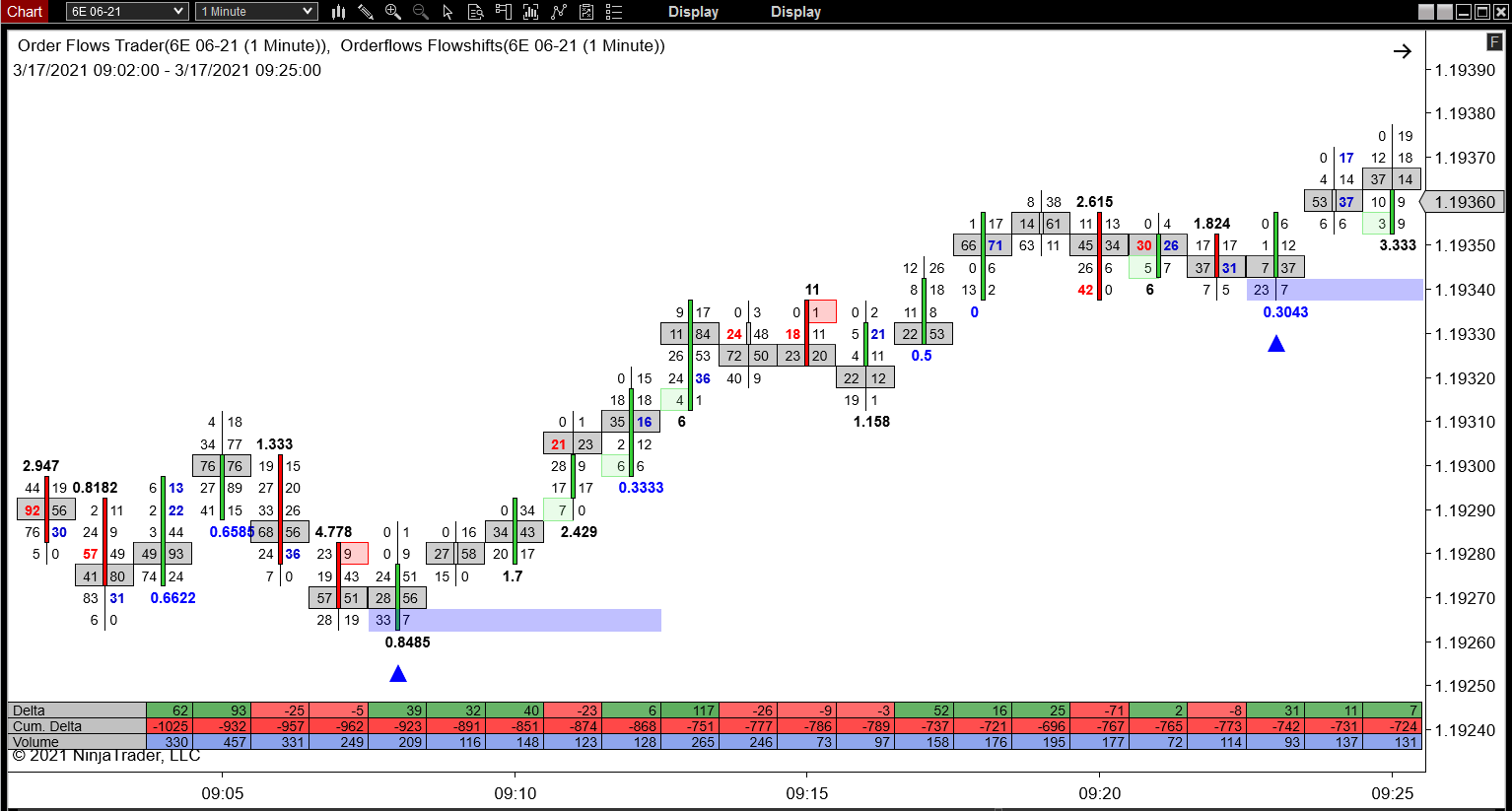

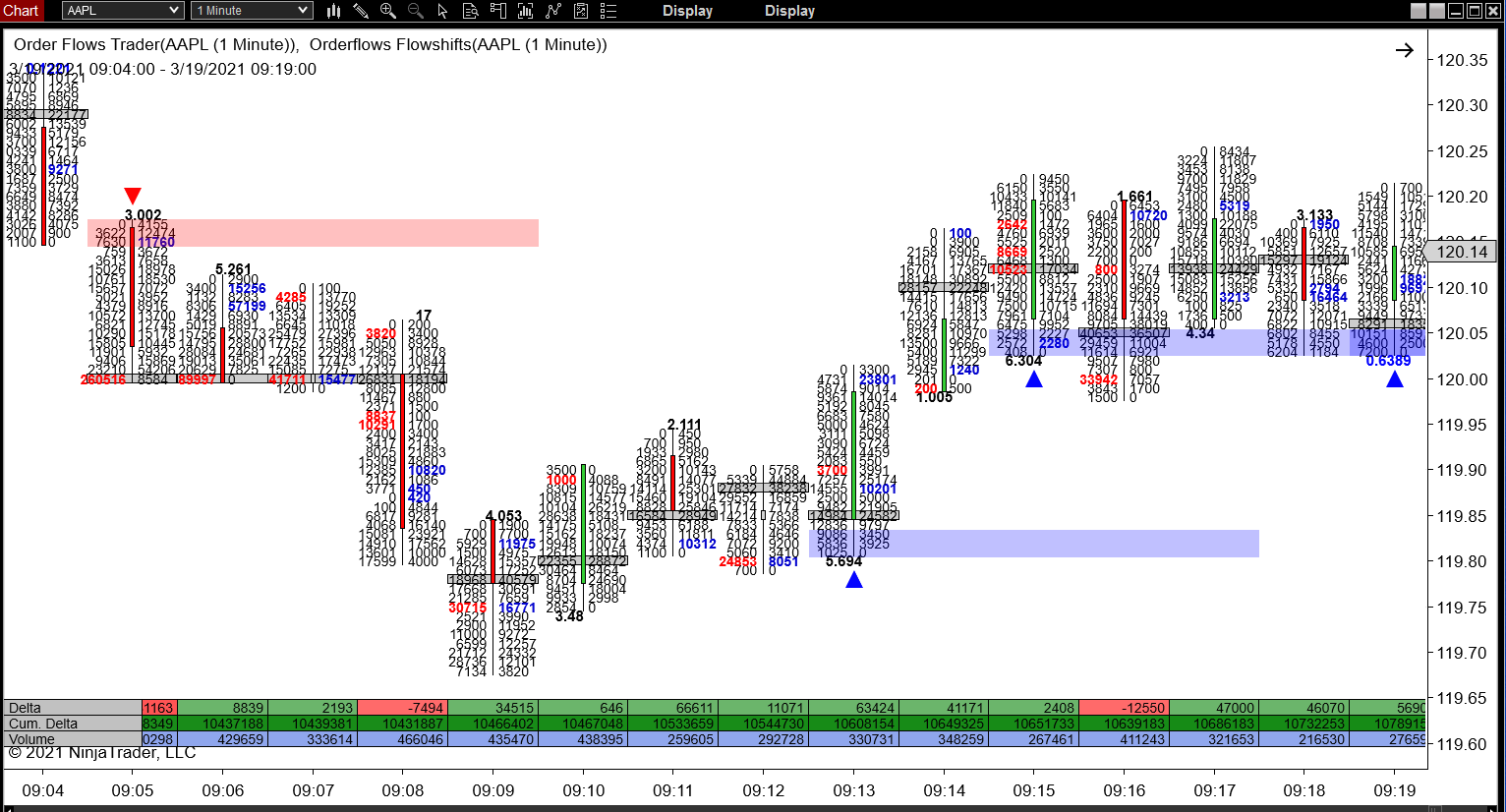

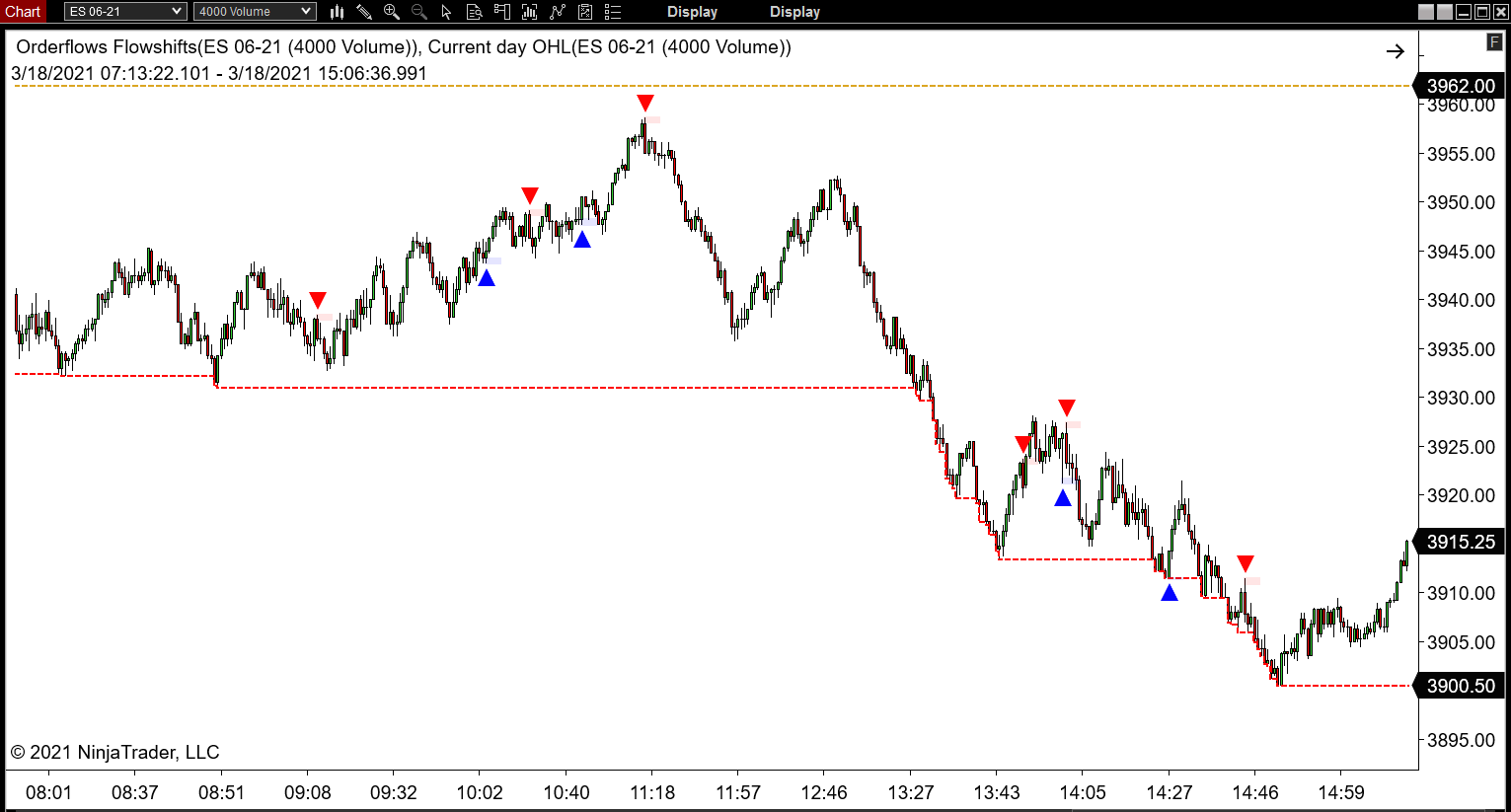

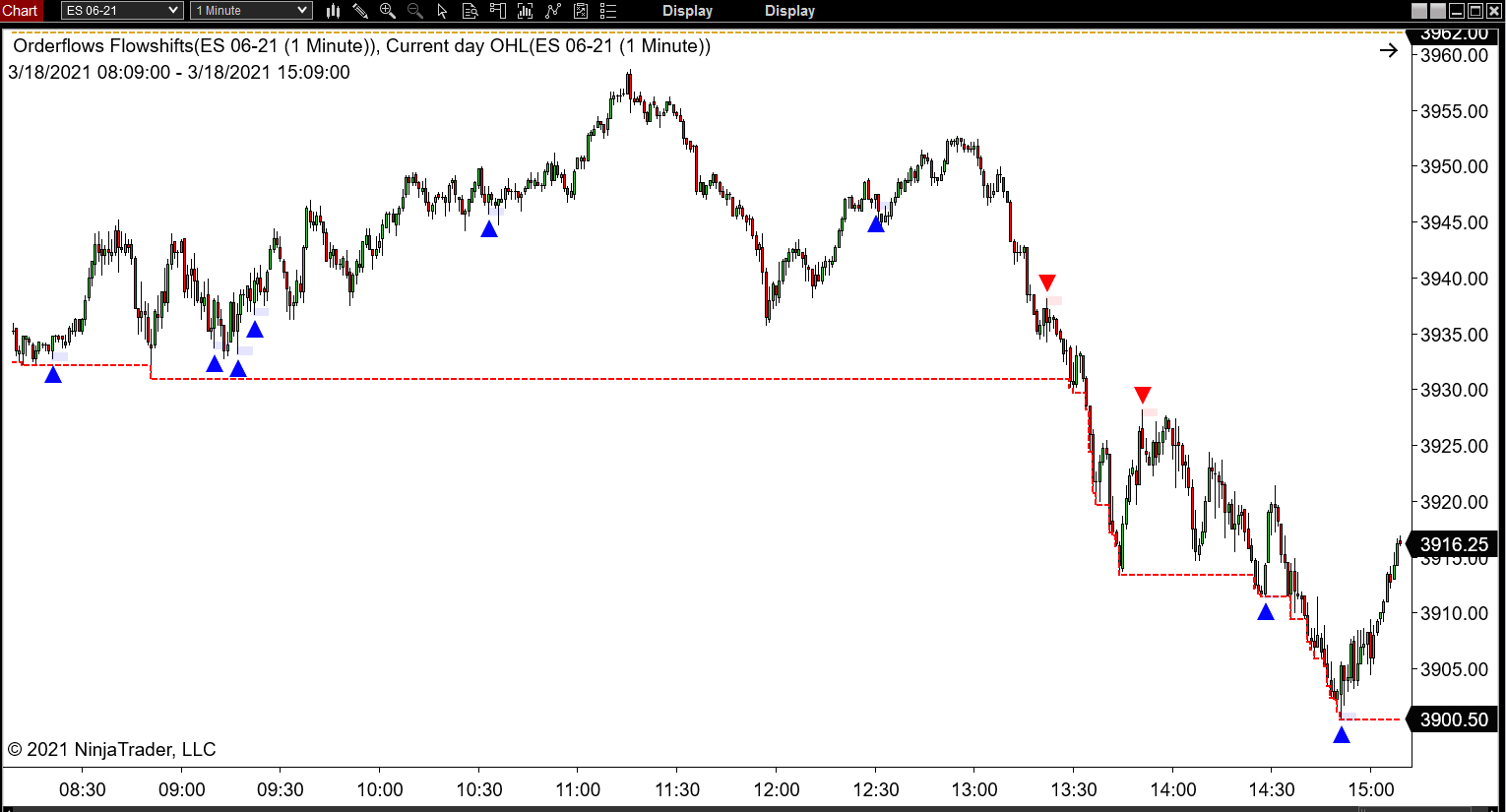

The Orderflows Flowshifts indicator works on Orderflows Trader order flow charts as well as regular bar and candlestick charts. So you don't have to abandon your existing chart that you already use.

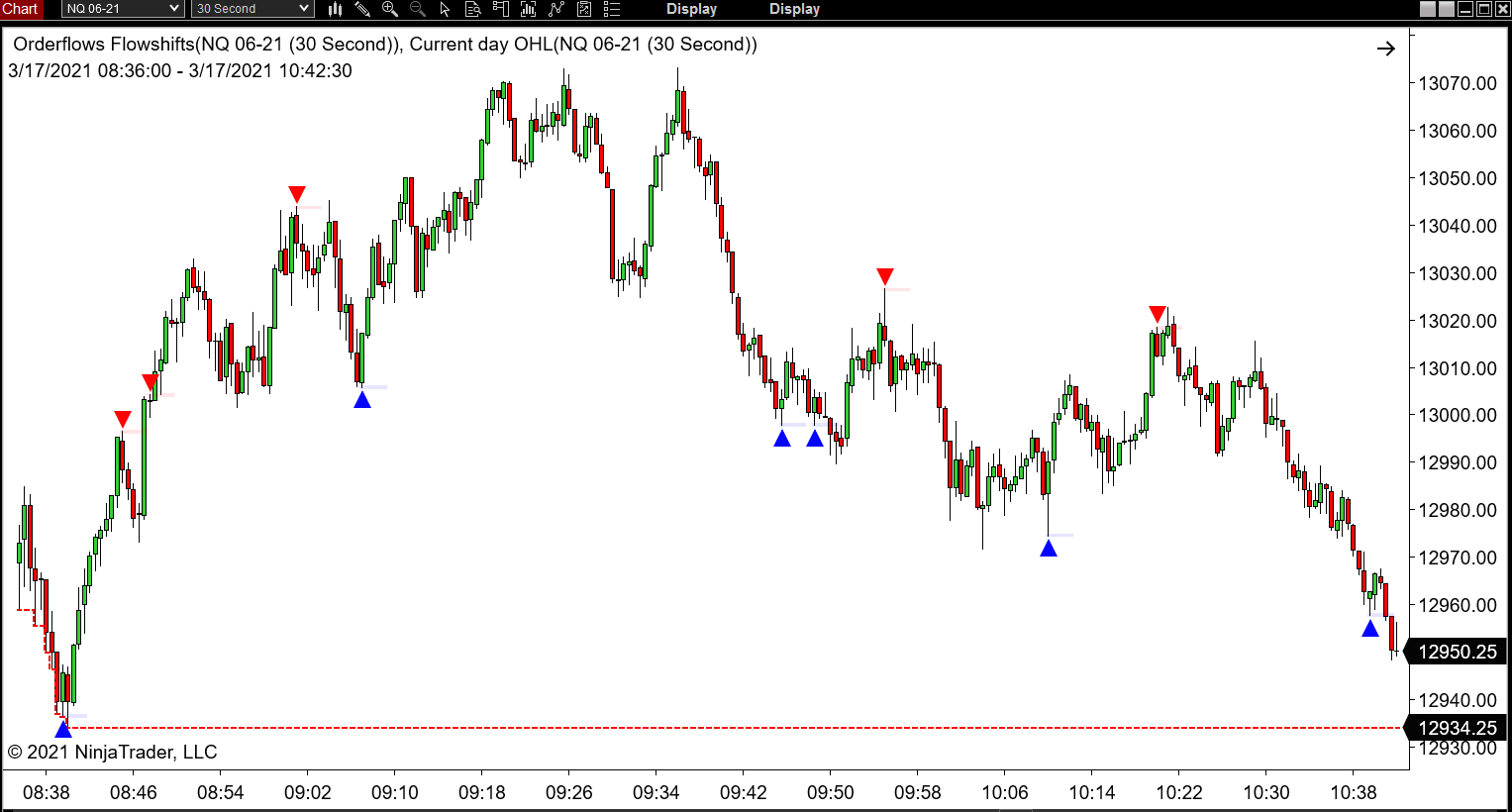

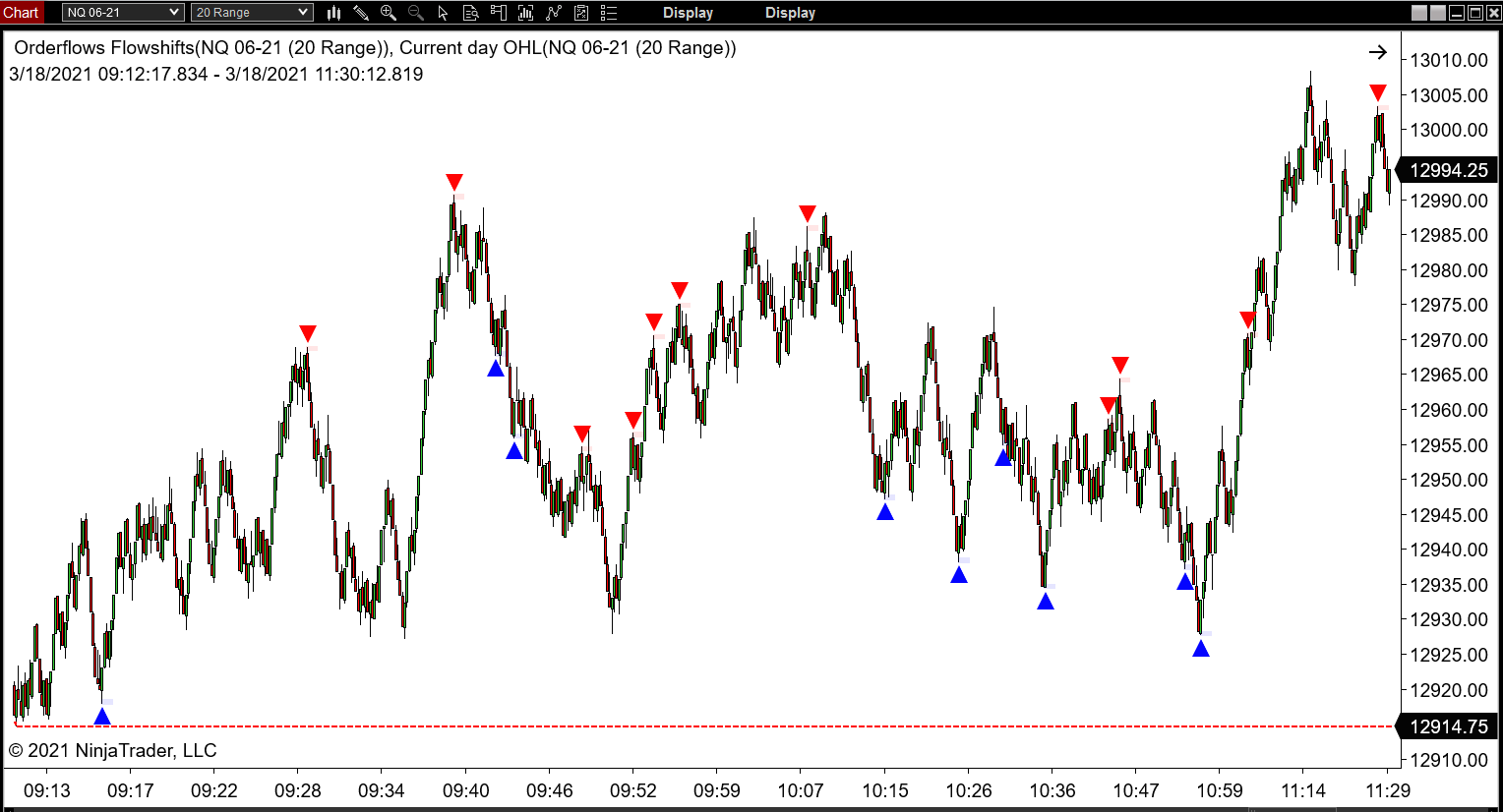

As you can see below, the Orderflows Flowshifts works on just about any chart type from minute based charts to volume based charts to tick based charts. Personally, I use minute based charts.

As you can see below, the Orderflows Flowshifts works on just about any chart type from minute based charts to volume based charts to tick based charts. Personally, I use minute based charts.

You can adjust the settings depending on your market and chart type that you trade to suit your trading style and plan. Not all markets trade the same and so depending on the market you will want to adjust the settings tighter or more loose. This is discussed in the user guide.

Make a choice... either keep doing what you are doing and buy all the rehashed garbage out there that gets you nowhere but broke and confused or make the choice to become a better trader by adding order flow analysis to your trading and see the results you really deserve. All that's left is to take the action to do it.

Different Ways To Show Trade Entry Signals:

Flowshifts Can Signal On The Entry Bar When The Conditions Are Met.

Flowshifts Can Draw A Zone Out From The Entry Bar.

Flowshifts Can Draw Just The Entry Signal With No Zones Drawn.

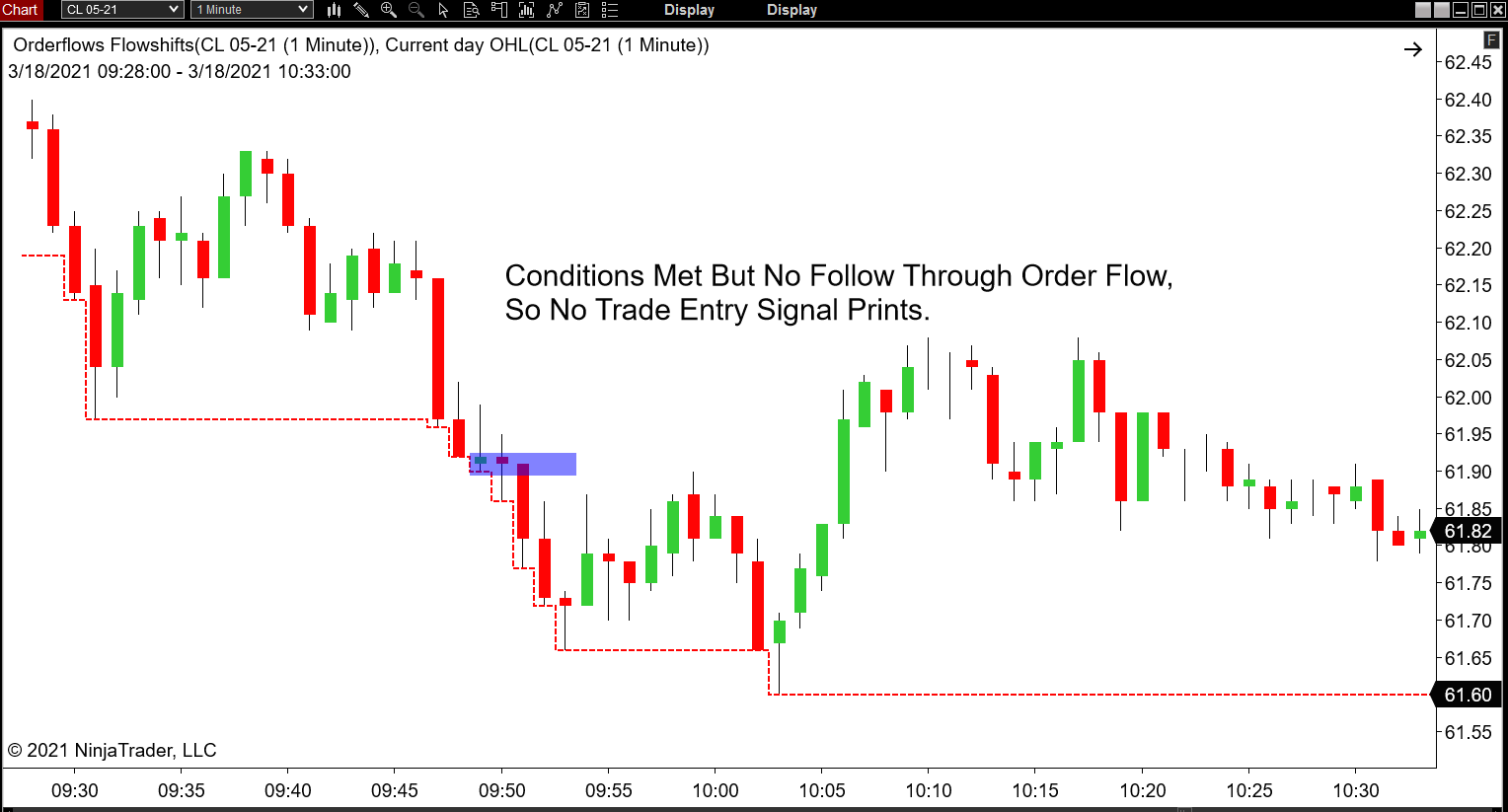

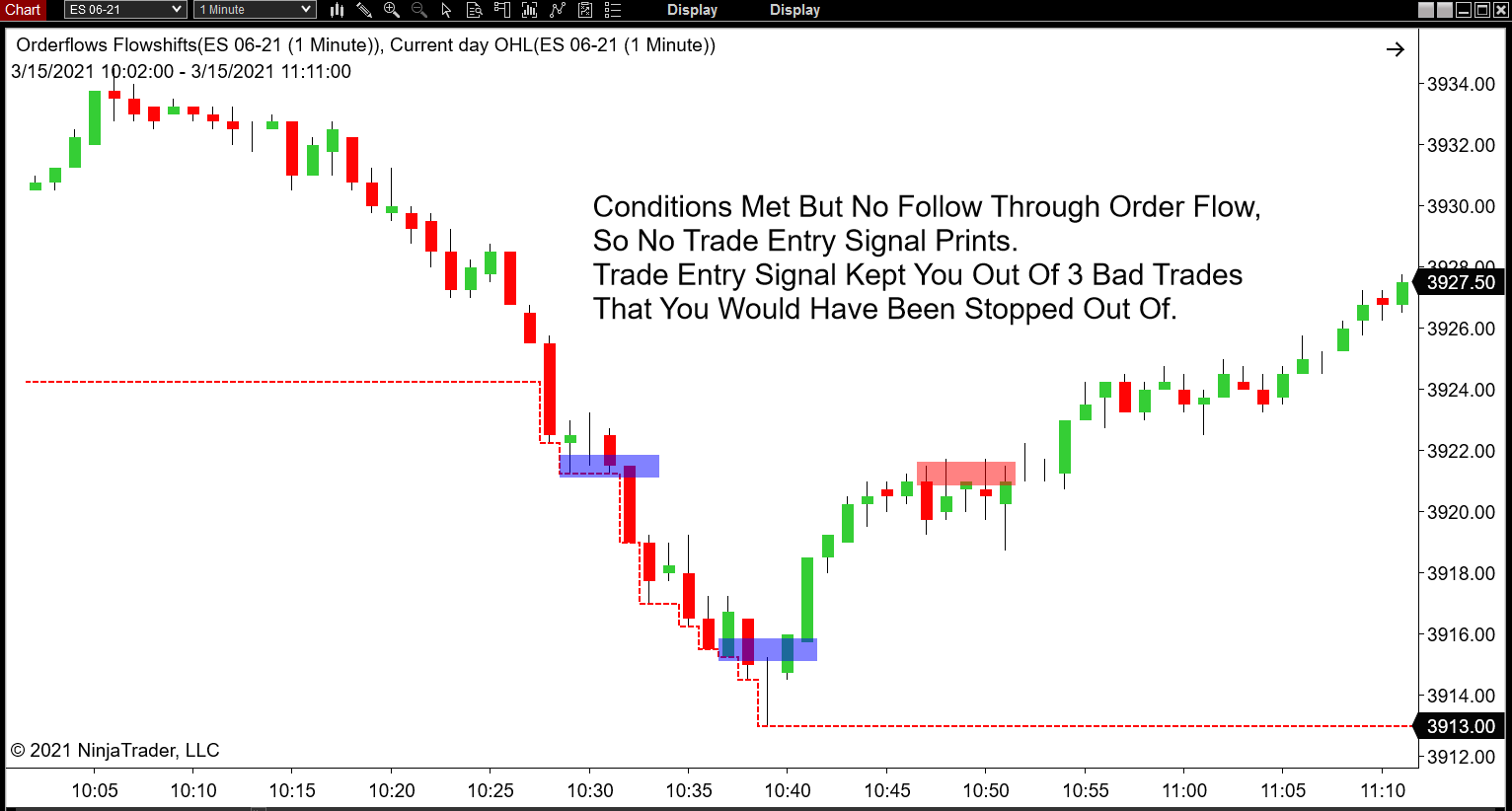

Flowshifts Can Also Use The Trade Entry Signal For Price Action Confirmation. The Trade Entry Signal setting means the order flow that follows the setup has to be in the direction of the setup before a trade signal is generated. This setting, when enabled, will keep you out of bad trades when the following order flow is not confirming the trade signal.

Trade Entry Signal Keeps You Out Of Trades Without Follow Through Order Flow.

Flowshifts is very flexible in viewing the trade signals.

Get Flowshifts Now

For a limited time you can get access to The Orderflows Flowshifts below for a one-time price of just $369!

It's simple, easy and 100% secure!

Clicking on the order link will redirect you to our secure payment processor page on PayPal.

After your order has been processed you will receive an email to your PayPal registered email (the one used for your PayPal payment) with the download information for the software and your license token for registration of the software. You will receive the email within 3-6 hours, usually sooner.

After your order has been processed you will receive an email to your PayPal registered email (the one used for your PayPal payment) with the download information for the software and your license token for registration of the software. You will receive the email within 3-6 hours, usually sooner.

FREQUENTLY ASKED QUESTIONS

Q. I already have Flowscalper. Is this the same thing?

A. No, Flowshifts and Flowscalper are two completely different order flow tools. The order flow information that Flowshifts analyzes is different than what Flowscalper analyzes. In fact, Flowshifts and Flowscalper compliment each other nicely and it is recommended to run both.

Q. Is the Flowshifts a footprint chart?

A. No. The Flowshifts is an order flow tools that analyzes all the data

you would normally see on a footprint chart - the delta, imbalances, POC and volume.

Q. Do I need a footprint chart to use the Flowshifts?

A. No, the Flowshifts will run on normal bar or candlestick chart as well as a footprint chart.

Q. What platform does the Flowshifts work on?

A. The Flowshifts is programmed for NinjaTrader 8.

Q. Do I need the PAID version of NinjaTrader 8 or can I use the FREE version?

A. The Flowshifts will run on the PAID version as well as the FREE version of NT8.

Q. I use Sierra Chart, is the Flowshifts available for Sierra Chart?

A. No. At the moment the Flowshifts is only available for NT8.

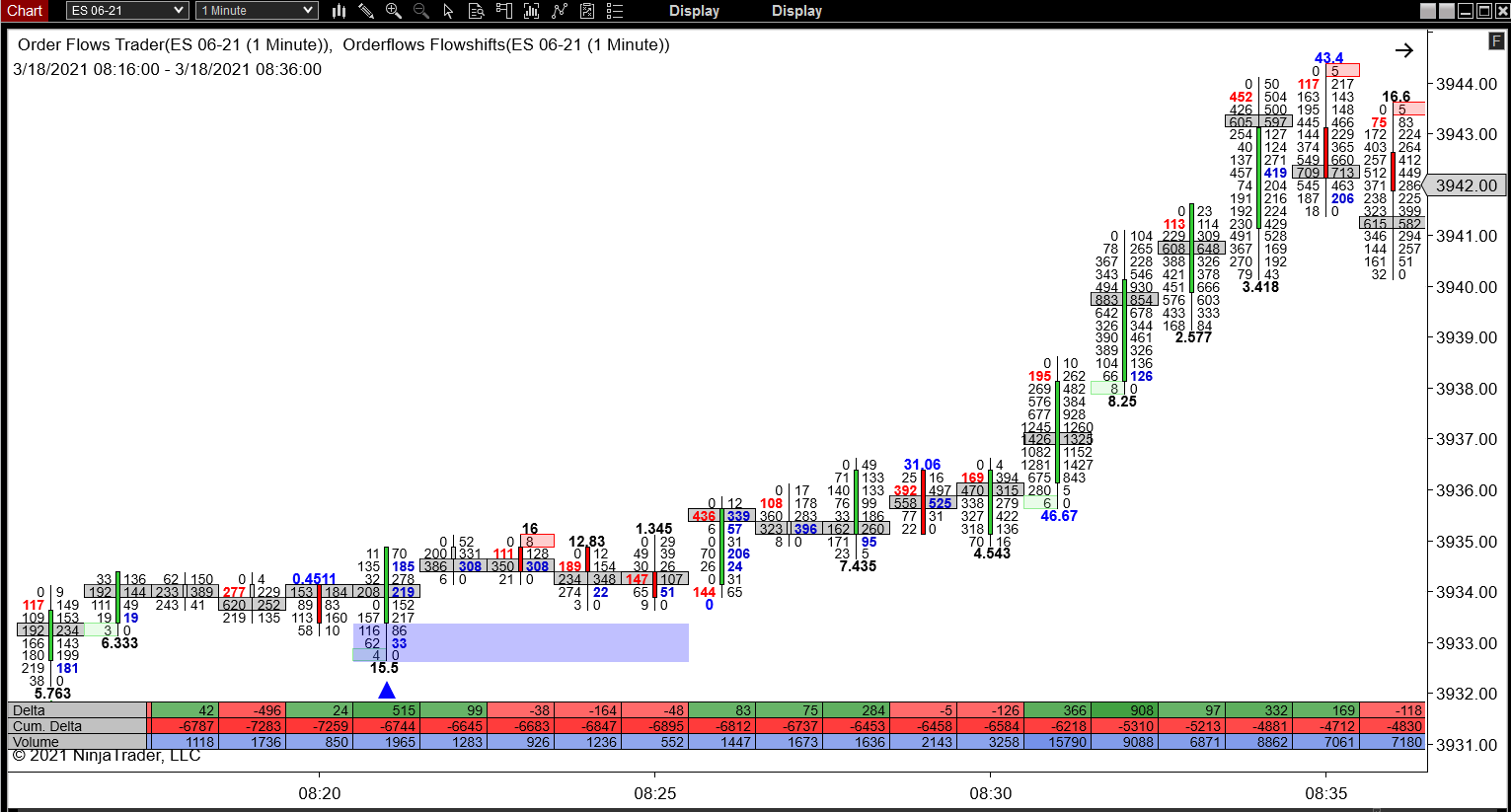

Q. I see you have different markets and different time frames, do I need to follow so many different markets?

A. No, I show you different markets and different chart types so you can see for yourself how the Flowshifts works under different conditions.

Q. Does the Flowshifts work with Markers Plus from The Indicator Store?

A. Yes it does.

Q. I trade Forex, can I use the Flowshifts to analyze FX markets?

A. Yes & No. Flowshifts will NOT work on Forex data. Forex data is not centralized. If you want to trade Forex, I would suggest you trade the FX futures available at the CME where the data is centralized and better to analyze the order flow.

Q. What markets work best with Flowshifts?

A. Futures and stocks work best with the Flowshifts.

Q. What time frame is best for Flowshifts?

A. Order flow in generally is best for shorter time frames. If you trade anything from 30 second charts to 5 minutes, Flowshifts performs well. When you start analyzing order flow over 15 minutes, the order flow that happened earlier is not as relevant.

A. No, Flowshifts and Flowscalper are two completely different order flow tools. The order flow information that Flowshifts analyzes is different than what Flowscalper analyzes. In fact, Flowshifts and Flowscalper compliment each other nicely and it is recommended to run both.

Q. Is the Flowshifts a footprint chart?

A. No. The Flowshifts is an order flow tools that analyzes all the data

you would normally see on a footprint chart - the delta, imbalances, POC and volume.

Q. Do I need a footprint chart to use the Flowshifts?

A. No, the Flowshifts will run on normal bar or candlestick chart as well as a footprint chart.

Q. What platform does the Flowshifts work on?

A. The Flowshifts is programmed for NinjaTrader 8.

Q. Do I need the PAID version of NinjaTrader 8 or can I use the FREE version?

A. The Flowshifts will run on the PAID version as well as the FREE version of NT8.

Q. I use Sierra Chart, is the Flowshifts available for Sierra Chart?

A. No. At the moment the Flowshifts is only available for NT8.

Q. I see you have different markets and different time frames, do I need to follow so many different markets?

A. No, I show you different markets and different chart types so you can see for yourself how the Flowshifts works under different conditions.

Q. Does the Flowshifts work with Markers Plus from The Indicator Store?

A. Yes it does.

Q. I trade Forex, can I use the Flowshifts to analyze FX markets?

A. Yes & No. Flowshifts will NOT work on Forex data. Forex data is not centralized. If you want to trade Forex, I would suggest you trade the FX futures available at the CME where the data is centralized and better to analyze the order flow.

Q. What markets work best with Flowshifts?

A. Futures and stocks work best with the Flowshifts.

Q. What time frame is best for Flowshifts?

A. Order flow in generally is best for shorter time frames. If you trade anything from 30 second charts to 5 minutes, Flowshifts performs well. When you start analyzing order flow over 15 minutes, the order flow that happened earlier is not as relevant.

Don't Take My Word For It, Take A Look At The Charts

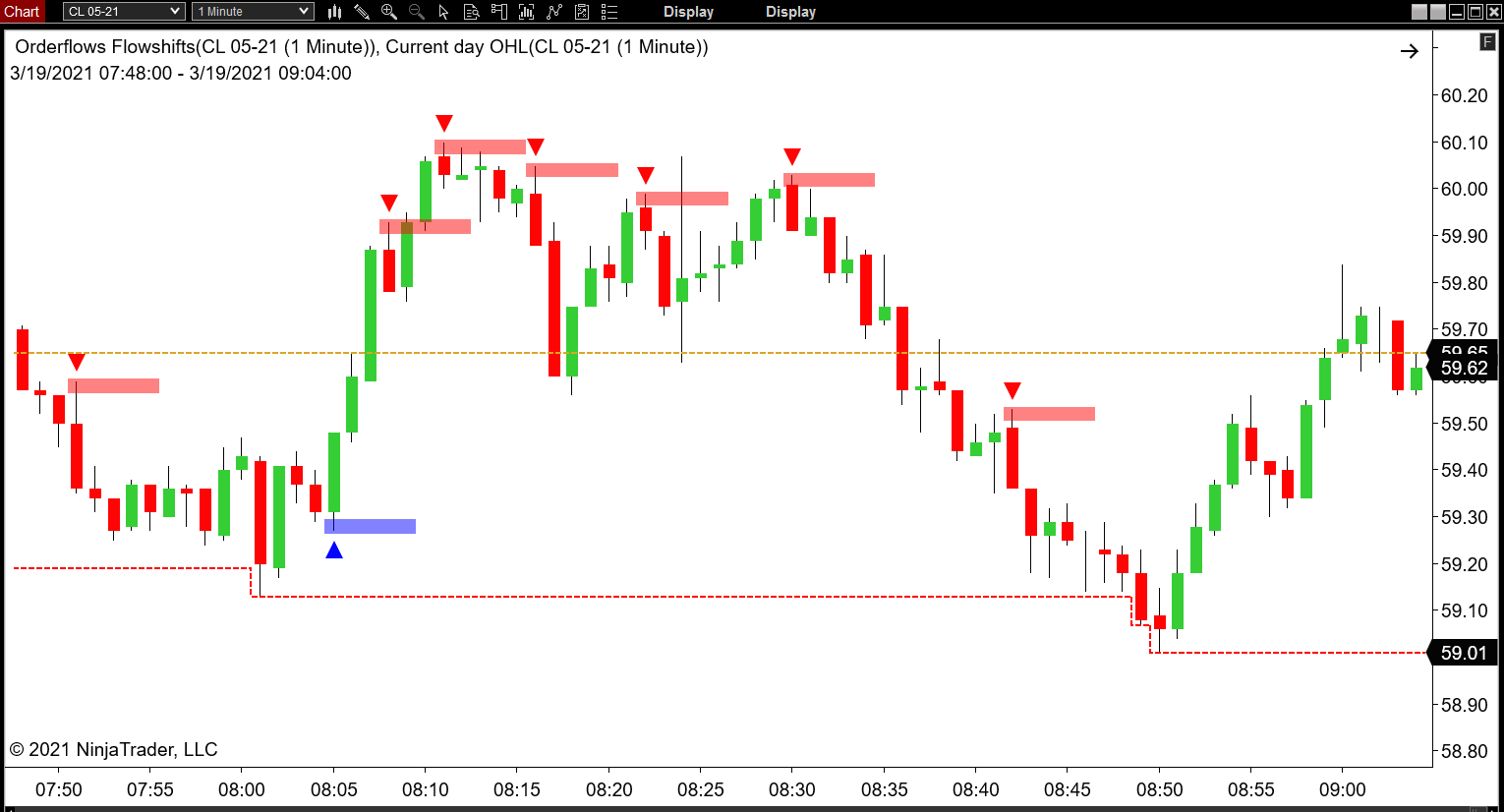

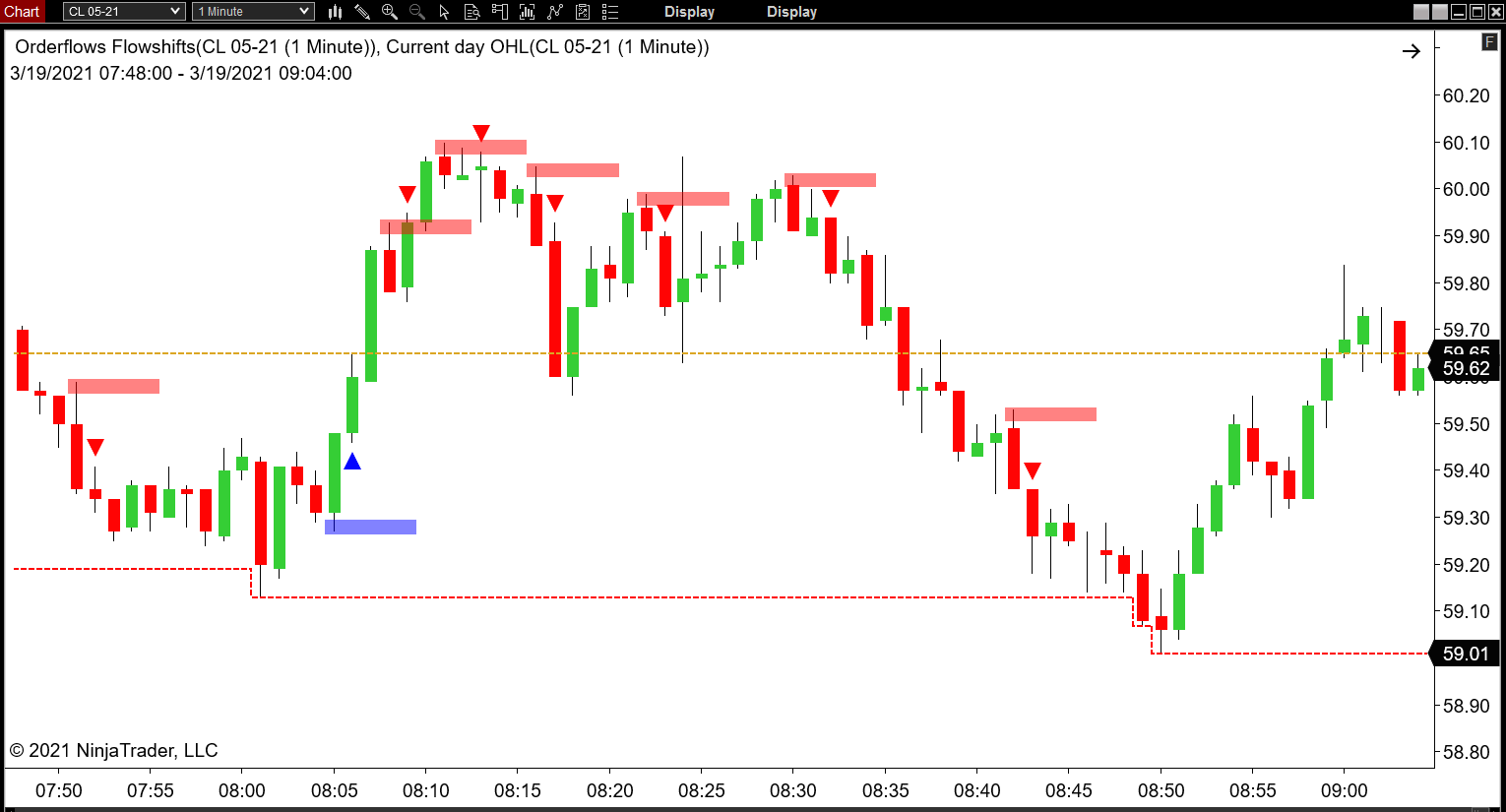

Depending on how you trade, you can adjust the settings based on your risk levels. Here is CL with the default settings:

Depending on how you trade, you can adjust the settings based on your risk levels. Here is CL with more liberal settings. You can even make the settings more liberal for more signals. But it is not about having more signals, but better signals.

Here is MNQ with the default settings. A little bit of chop around the highs of day. But once the market sorted itself out and the the trends started, Orderflows Shifts picked up on the trends early and alerted the trader to them as soon as they started.

Depending on how you trade, you can adjust the settings for stricter settings which tighten the set up requirements.

Look, I can show you chart after chart after chart that look great. But at the end of the day, you have to make the decision to get started. So stop wasting time and let's get to trading.

What Are You Waiting For?

Get Started Now

Get Started Now

Copyright 2021 - Flowshifts.com & Orderflows.com- All rights reserved

All Rights Reserved. Reproduction without permission prohibited. All of the foregoing is commentary for informational purposes only. All statements and expressions are the opinion of Orderflows.com and are not meant to be a solicitation or recommendation to buy, sell, or hold securities.

The information presented herein and on our web site has been obtained from sources believed to be reliable, but its accuracy is not guaranteed.

Estimates, assumptions and other forward-looking information are subject to the limits of forecasting. Actual future developments may differ material due to many factors.

DISCLAIMER

RISK DISCLOSURE:

Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLAIMER:

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT TRADING RESULTS.

All Rights Reserved. Reproduction without permission prohibited. All of the foregoing is commentary for informational purposes only. All statements and expressions are the opinion of Orderflows.com and are not meant to be a solicitation or recommendation to buy, sell, or hold securities.

The information presented herein and on our web site has been obtained from sources believed to be reliable, but its accuracy is not guaranteed.

Estimates, assumptions and other forward-looking information are subject to the limits of forecasting. Actual future developments may differ material due to many factors.

DISCLAIMER

RISK DISCLOSURE:

Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLAIMER:

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT TRADING RESULTS.

Thanks for subscribing. Share your unique referral link to get points to win prizes..

Loading..